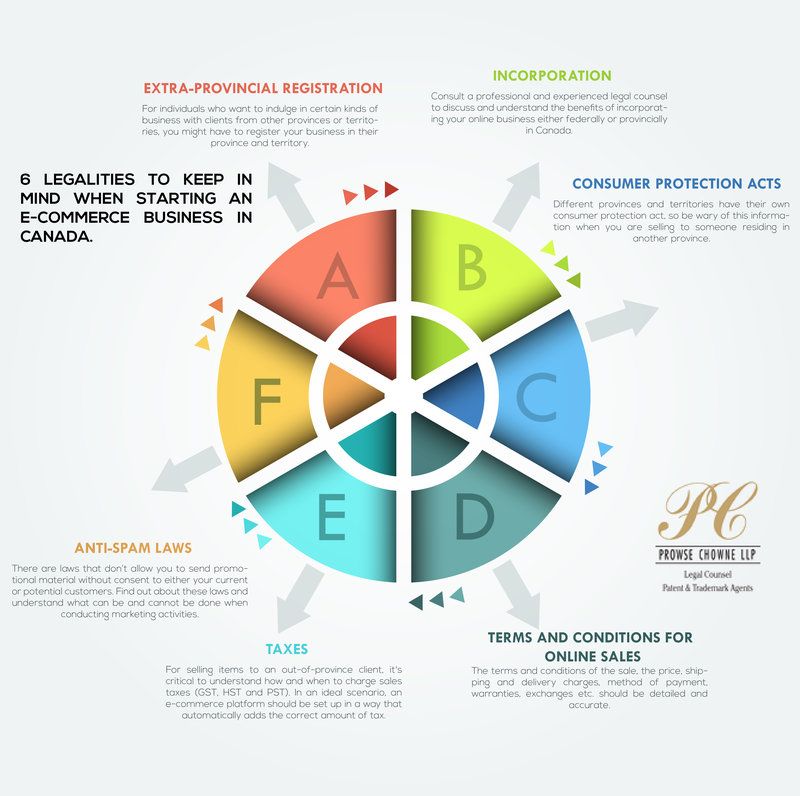

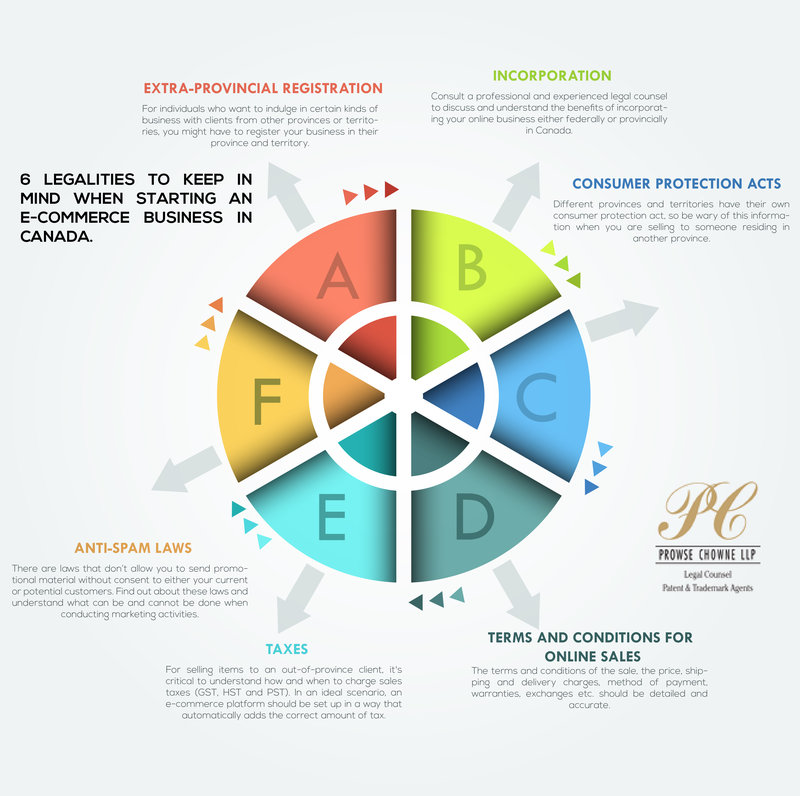

It is not hard to understand what makes the prospect of starting an e-commerce business such a lucrative idea to many young and budding entrepreneurs. An online marketplace instantly provides you access to a global marketplace. A marketplace that is online 24×7 and is easily accessible from the comfort of your home. Although the upside is very exciting, the important point to remember is that e-commerce isn’t as simple as making your sales and shipping out orders. You should have sufficient knowledge regarding the selling of goods in different regions along with the terms and conditions for the sale. Also, some regulations that apply to traditional businesses will also apply to online business. Make sure you look into the following things before you get into the online business:

1. Extra-provincial registration

For individuals who want to indulge in certain kinds of business with clients from other provinces or territories, you might have to register your business in their province and territory.

2. Incorporation

Consult a professional and experienced legal counsel to discuss and understand the benefits of incorporating your online business either federally or provincially in Canada.

3. Consumer Protection Acts

Different provinces and territories have their own consumer protection act, so be wary of this information when you are selling to someone residing in another province. Find out the different requirements that are required in that jurisdiction.

4. Terms and conditions for online sales

The terms and conditions of the sale, the price, shipping and delivery charges, method of payment, warranties, exchanges etc. should be detailed and accurate. Make sure your clients accept the terms and conditions and have read them. Use the Internet sales harmonization template which will help you comply with some of the requirements for your Internet sales contract.

5. Taxes

For selling items to an out-of-province client, it’s critical to understand how and when to charge sales taxes (GST, HST and PST). In an ideal scenario, an e-commerce platform should be set up in a way that automatically adds the correct amount of tax. Make sure that you have tested the system, ensure that the system is up-to-date and verify that it is accurately set up.

There are laws that don’t allow you to send promotional material without consent to either your current or potential customers. Find out about these laws and understand what can be and cannot be done when conducting marketing activities. Also, selling products or services online requires you to fulfil certain requirements. Knowing about these requirements will allow you to mitigate the risk of disputes, liability, and cancellations.

With hard work, attention to detail and a little bit of ingenuity, you can turn your online business into success. If you’re serious about starting an e-commerce business, make sure you get sound legal counsel.